Speakers Virtual 2023

Details to follow shortly for 2024

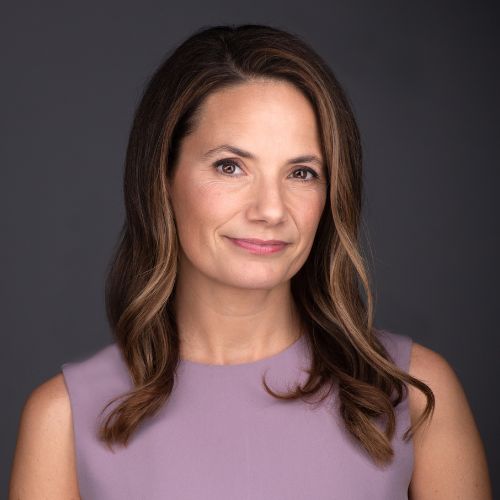

Jane N. Abitanta

Founder & CEO

Perceval Associates, Inc,

Leadership and communications coach, Jane Abitanta is the founder of Perceval Associates, a consultancy focused on helping leaders deliver more compelling messages to their investors, clients and sales teams. She has advised many of the world’s top institutional fund managers, family offices, and countless hedge funds and private equity firms and their portfolio companies including management teams from healthcare, technology, insurance, food service and entertainment companies. Jane is particularly skilled in helping management teams to more effectively articulate their particular edge in terms of the real-world needs of their markets. Jane is an advisor to Go-to-Eleven Entertainment, a board member of the Council for Economic Education/Invest in Girls and former director of 100 Women in Finance. She is an executive facilitator for the University of Delaware’s Women in Leadership program. Jane earned an MBA in Finance and Investment Management from Fordham University, and an MA in Social-Organizational Psychology and Change from Columbia University.

Christopher Ailman

Chief Investment Officer

CalSTRS

Mr. Ailman has been the Chief Investment Officer of the $315+ billion CalSTRS, for over 23 years. Mr. Ailman leads an investment staff of 230. He joined CalSTRS in 2000 and is one of the longest serving public CIO’s in the country. He has over 38 years of institutional investment experience. Annually, he is listed as one of the top ten CIO’s in the USA and globally by the institutional investment media. integration of the standards in security analysis and portfolio construction. He currently serves as the Chair of the 300 Club of global CIO’s, and the Kroner Financial Research Center at UCSD Rady School. He is one of the three co-Chairs of the Milken Institute’s Global Capital Markets Advisory Committee (GCMAC). He also represents institutional investors on the MSCI Management Advisory Committee, the EDHEC Risk Institute, and the Toigo Foundation Advisory Board. Over his career, he has served on numerous boards and advisory boards in the U.S. and U.K. such as PRI, ICGN, PPI, and as the inaugural Chair of the SASB Investor Advisory Board. He has received numerous awards and recognitions over his career, from CIO of the Year in 2000, the NAA Latino service award, 2011 Large Plan CIO of the year, and Investment Innovator of the Year in 2011, 2013, and again in 2018, all culminating in 2017, with receiving the inaugural Institutional Investor Magazine Lifetime Achievement Award. Mr. Ailman is a regular guest on the TV and radio, CNBC, Bloomberg, and Nightly Business Report. He is frequently quoted in in major financial publications such as the Financial Times, Wall Street Journal, and Barron’s. He has a BA from UCSB, an FSA, the Fundamentals in Sustainable Accounting credential from SASB. He has been married for 39 years with three adult daughters and two Grandchildren and is a committed Promise Keeper.

Maggie Arvedlund

CEO & Managing Partner

Turning Rock Partners

Ms. Arvedlund is CEO and Managing Partner of Turning Rock. At Turning Rock, Ms. Arvedlund serves as head of the Firm and is responsible for strategic direction and overall decision making for the business. Prior to founding Turning Rock, Ms. Arvedlund was a Managing Director at Fortress Investment Group where she spent eight years. Fortress Investment Group is a global investment firm. While at Fortress, Ms. Arvedlund was responsible for private equity and debt investments for the Fortress Partners Fund, a multi-strategy vehicle which invested across asset classes and capital structures. During her tenure at Fortress, Ms. Arvedlund served on the Investment Committee from 2010-2015. Prior to joining Fortress, Ms. Arvedlund worked at Hall Capital Partners where she held roles in the portfolio management and research divisions. Hall Capital Partners is a privately held registered investment advisory firm. Prior to Hall Capital Partners, Ms. Arvedlund held a number of senior operating roles in several privately held businesses. Ms. Arvedlund received a BS with Honors from Vanderbilt University in Economics and an MBA in Finance from NYU’s Stern School of Business. Ms. Arvedlund serves on several non-profit boards including Summer Search New York City and is a founding member of the NYU Stern Private Equity Advisory Board. Ms. Arvedlund is a member of the Economic Club of New York and serves on the U.S. Small Business Administration Council for Underserved Communities.

Sabrina Bainbridge

Associate Director, Impact Investments

Spring Point Partners

Sabrina is the Associate Director for Spring Point Partners LLC, a Philadelphia-based social impact organization that invests in transformative leaders, networks, and solutions that power community change and advance justice. She leverages her international impact investing experience and background in incubator programming design to support SPP’s investment portfolio and partners. Sabrina is passionate about creating a more inclusive economic system through the use of innovative finance.

Drianne Benner

Managing Director

Appomattox

Regina Bernal

Director Strategic Inclusion

Connect

I am deeply driven and intentional – With 10+ years of experience developing and implementing impactful strategies and partnerships in the innovation economy, I bring an unwavering determination to everything I set my mind to. I have over a decade of experience working with entrepreneurs and investors, I know how to connect investors and partners for a win-win (right deals, at the right time, with good people).

As the Director for Strategic Inclusion at Connect, I serve innovators and entrepreneurs in Southern California by providing access to investors, mentors, and education. I am an authentic connector of people and opportunities. I am deeply committed to fostering diversity. I infuse inclusion into everything I do. Bringing different people, backgrounds, and thinking to the table is how we build and scale great companies. Storytelling, public speaking, and being on stage, including being a TEDx speaker, allow me to use my voice to make an impact.

Antje Biber

Head of SDG Office

FERI AG

As a member of the Management Board and Head of SDG Office at FERI AG, Antje Biber is responsible for the development and implementation of the FERI Group’s sustainability strategy. Public engagement, knowledge transfer and the development of innovative advisory and investment concepts in the field of sustainable investments are core elements of her work. She actively collaborates with various global institutions (including the UN, EC, WEF, KFW), has numerous educational assignments and writes scientific studies on environmental and social topics published by the FERI Cognitive Finance Institute. She is a strong advocate for the integration of the SDGs into the financial industry and business. She joined FERI in 2005 and led the FERI Group’s international business strategy for many years. She was Chairwoman of the Board of Directors of FERI (Switzerland) AG until 2021. Earlier in her 25 years of experience in the financial industry, the mathematician and investment expert worked for Skandia Group, BNP Paribas and S&P Fund Services.

Anda Bordean

Managing Director

The RockCreek Group

Anda Bordean, Managing Director Anda Bordean is a Managing Director at RockCreek, where she sources, develops, and monitors investment opportunities, including manager selection, due diligence, qualitative and quantitative research, risk management, portfolio construction, and strategy. Before joining RockCreek, Anda spent five years at Soros Fund Management, where she performed due diligence on hedge fund managers across all strategies. At Soros she was heavily involved in sourcing new manager relationships, as well as monitoring existing relationships for Soros’ $12 billion external manager portfolio. Prior to Soros, Anda was an Analyst in Goldman Sachs’ Hedge Fund Strategies Group with a focus on equity long/short and credit managers. She holds an A.B., cum laude, in Economics from Harvard University.

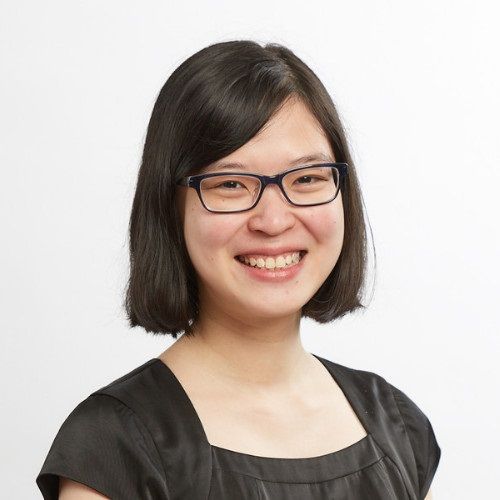

Tracy Cao

Vice President, Team Lead Manager Research, Multi Manager Strategies

Xponance

Tracy Cao is Vice President, Team Lead for Manager Research, Multi-Manager Strategies at Xponance and joined the firm in 2013. In this capacity, Tracy identifies and evaluates prospective asset managers for the multi-manager strategy platform on a global basis. Additionally, she sources boutique managers, conducts frequent on-site due diligence meetings, and produces original research for clients on a variety of global equity related topics. Prior to Xponance, Tracy was an equity research analyst intern at UBS Investment Bank, in both Amsterdam and Hong Kong, as well as an investment advisory intern at Merrill Lynch Wealth Management in Baltimore, Maryland. Tracy earned her M.S. in Finance from Johns Hopkins University; her M.S. in Business Economics from University of Amsterdam in The Netherlands; and her B.S. in Insurance at Dongbei University of Finance and Economics in China. She is a CFA Charterholder.

Jenni Chamberlain

Founder and CEO

Altree Capital

Jenni Chamberlain serves as Chief Executive Officer of Altree Capital Ltd. (“Altree Capital”) and Portfolio Manager for the Africa Opportunities Fund SAC Ltd and its segregated portfolio companies, as well as the Founding Partner for the Altree Kadzi Gender Climate SPV. Jenni was named to the Africa Asset Management Power 50 in each of the two years consecutive years of the survey being placed in the top 10 in the second year. Jenni also managed the Altree Credit Fund SAC from May 2014 – September 2018. She is raising funding for the Altree Kadzi Gender Climate Fund, whilst currently investing via the Altree Kadzi Gender Climate SPV which invests with a gender-lens and climate-smart approach where technology can be used to scale in MSMEs in sub-Saharan Africa.

Myra Chan

Sales Director and Member of Sustainability Committee

Aubrey Capital Management Limited

Myra joined the Aubrey in 2019 and is in charge of business development in Europe ex-UK. She is a member of the Sustainability Committee and contributes to Aubrey’s sustainability practice. Before her relocation to Europe, she was a senior banker at Citibank Private Bank and Banque Privée Edmond de Rothschild in Hong Kong, managing investments for ultra high net-worth individuals. Prior to that, she was a division head at JP Morgan’s Structured Product Distribution, tailoring financial solutions for private clients and family offices in Asia Pacific. She had also worked in areas of institutional broking in New York. In addition to being a Chartered Financial Analyst, she holds a Master’s degree from the University of Hong Kong, and a B.A. from International Christian University in Japan, and serves as a volunteer in the commune of Poissy, France.

Charmaine Chin

Managing Director

Blackstone

Charmaine Chin is a Managing Director in the Hedge Fund Solutions Group (BAAM) and the Head of Asia Manager Selection. Ms. Chin is based in Singapore and leads BAAM’s investment activities across Asia. Before joining Blackstone, Ms. Chin worked at Fullerton Fund Management in Singapore where she was involved in managing a global portfolio of hedge funds, private equity and private credit funds. She also led due diligence for co-investments and late-stage growth investments. Prior to Fullerton, Ms. Chin spent 12 years as a Partner and Managing Director at K2 Advisors in New York, part of Franklin Templeton’s Alternatives division. There she oversaw all of K2’s investments in Asia, as well as all investments globally in credit and event-driven strategies. Prior to K2, Ms. Chin worked at Goldman Sachs in the Special Situations Group, focused on opportunistic investing across equities and credit. Ms. Chin began her career in the investment banking division of Goldman Sachs in New York and Hong Kong. Ms. Chin received a BA from Harvard University, where she graduated magna cum laude and Phi Beta Kappa.

Anna Colombatti

Investment COO

AXA IM-Architas

A Chartered Investment professional with broad experience in Asset Management and Financial Services as an executive and non executive. Anna has two decades global experience in the selection, allocation and oversight of investment products, firms and service providers. She is passionate about digital transformation, sustainability and D&I. Currently Anna is the functional COO for the Front Office department of the AXA IM multi managers business, responsible for investment and ESG research, due diligence and all operational initiatives.

Michele Colucci

Founder, Managing Partner

DigitalDx Ventures

Michele Colucci is a venture capital thought leader, lawyer, investor, serial entrepreneur, and philanthropist. She has authored five patents in the technology space and founded companies in the legal, technology, retail, and entertainment spaces. As Founder and Managing Partner of DigitalDx Ventures, Colucci is committed to impacting healthcare by investing in companies using technology to enable doctors to make better, earlier and less invasive diagnostic decisions. Through her firm, she seeks to impact 2 billion lives with earlier, less invasive, less expensive and more accurate information for healthcare decision making and greater access to quality healthcare for all. Her Board experience includes serving on public and private boards, past and present, such as Global Indemnity Group, Biotia, Optina Diagnostics, Prime Genomics, NowDx, Delphi Diagnostics, Nephrosant and GLX Analytix. She has been a frequent guest lecturer at Stanford University’s School of Engineering in global marketing and entrepreneurship. In 2017, Colucci was named West Coast Ambassador by the Nobel Laureate Foundation and in 2023 she was awarded Best MedTech Investor by Silicon Valley’s Gentry Magazine. Her venture fund, DigitalDx Ventures, has been recognized in 2023 as Most Innovative Fund and Best ESG Program by PEI Media. She earned her B.A. and law degree from Georgetown University and an M.F.A from the American Film Institute. Her extensive experience operating in highly regulated verticals has focused on areas including management, financial, strategic, marketing and legal.

Erika Cramer

Partner

CANY Capital LLC

Ms. Cramer is a co-Founder and Managing Partner for How Women Invest LLC, a gender lens venture firm investing in tech-enabled startups. She is a 25-year veteran investment banker in the financial services industry having focused on mergers and acquisitions within the asset management, wealth advisory and fintech solution sectors. Over the course of her career, she advised public and private financial services firms on over 52 transactions representing over $240 billion in assets under management in consolidations. She co-founded an investment banking boutique which was acquired by Raymond James Financial and formed two registered broker dealers where she served as Chief Compliance Officer. A Latina, she is an experienced board director with Prospanica and Trips for Kids Bay Area, and previously with Atlanta Life Insurance Company and OpenInvest (fintech firm acquired by J.P. Morgan Chase). Ms. Cramer is an active speaker and mentor for women in finance and leadership; she is a member of How Women Lead, the Athena Alliance, and 100 Women in Finance. Along with her husband, Ms. Cramer is engaged with their family office. She is the mother of two daughters, an advocate for individuals with intellectual disabilities, and can be found cycling the scenic routes of California and New York. Erika earned an MBA in Finance at Pace University and bachelor’s degree in Finance from West Virginia University.

Marie-Céline Damnon

Investment Associate

Capricorn Investment Group

Marie-Céline Damnon is an Associate on the Investment Team, responsible for investment sourcing, due diligence, and structuring. She joined the firm in 2018. Marie-Céline earned her Master in Management and MSc in Sustainability and Social Innovation from HEC Paris.

Nancy Davis

PM for the IVOL ETF & CIO Quadratic Capital

Quadratic

Nancy Davis Founder, Quadratic Capital PM for the IVOL and BNDD ETFs Nancy Davis founded Quadratic Capital in 2013. She is the portfolio manager for The Quadratic Interest Rate Volatility and Inflation Hedge ETF (NYSE Ticker: IVOL) and The Quadratic Deflation ETF (NYSE Ticker: BNDD). Both funds are Treasury funds that are long fixed income volatility. Nancy has been the recipient of numerous industry recognitions. Barron’s named her to their inaugural list of the “100 Most Influential Women in U.S. Finance.” Institutional Investor called her a “Rising Star of Hedge Funds.” The Hedge Fund Journal tapped her as one of “Tomorrow’s Titans.” Nancy began her career at Goldman Sachs where she spent nearly a decade, the last seven with the proprietary trading group where she rose to become the Head of Credit, Derivatives and OTC Trading. Prior to founding Quadratic Capital Management, she served as a portfolio manager at JP Morgan’s Hedge Fund Highbridge Capital Management.

Ashley Dennig

Director of Investments

The Broad Foundation

Ashley Dennig is a Director of Investments at the Broad Family Office and Foundations, helping to oversee the Foundations’ and the Broad family’s investment portfolios across asset classes. Before joining Broad in 2021, Ashley was a Vice President at Franklin Templeton Private Equity. Prior to FTPE, Ashley served on the investment teams at San Francisco Employees’ Retirement System and Kingsbridge/Riverun multi-family office. She started her career at Goldman Sachs. Ashley graduated from Princeton University with a BA in History. She was born and raised in Hong Kong.

Daphne Dickson

COO, Director of Alternative Investments

SFG Asset Advisors

Daphne J. Dickson is COO and director of alternative investments at SFG Asset Advisors. She co-manages the alternative investment strategy, research and allocation. Additionally, Daphne oversees the legal, compliance, operations and governance of the family office and associated entities.

Christopher R. DiFusco

Chief Investment Officer

City of Philadelphia

Mr. DiFusco is responsible for the oversight of the Philadelphia Municipal Employee Retirement System’s $7 billion defined pension plan and the $1.7 billion deferred compensation plan. Mr. DiFusco supervises an Investment Staff of six other investment professionals (and two administrative specialists) to monitor the System’s portfolio and recommend investments and strategies across various asset classes. He is in charge of developing agendas & leading Investment Committee meetings, working in conjunction with the plan’s general consultant on asset allocation studies, and re-balancing the portfolio (or segments of the portfolio) on a monthly (or as needed) basis. Mr. DiFusco works in conjunction with the Board, Investment Staff, and the consultants to develop short & long term investment goals. He develops, recommends, and implements investment strategies in the domestic and international public and private markets. Mr. DiFusco evaluates investment managers, recommends changes, if required, to hire or terminate managers. Monitor, analyze, and report on all investment costs, including commissions, manager fees, and custodian charges. Manage, in conjunction with the assigned member(s) of Investment Staff and the custodial bank, the Plan’s cash flow. Oversee the Board’s programs and policies related to minority, female, disabled and locally owned investment firms and brokers. Mr. DiFusco also served as the Chief Investment Officer for the $500 million PGW Retirement Reserve since November 2013. Mr. DiFusco sits as Vice-chair on the Board of Trustees for the PGW OPEB Trust.

Danielle Dobson

Vice President

HarbourVest Partners

Danielle Dobson joined HarbourVest in 2019 and focuses on US venture, buyout, and credit investments, including the evaluation, due diligence, and monitoring of partnerships. Danielle joined the Firm from APG Asset Management in New York, where she was an associate responsible for sourcing, conducting due diligence, and executing private equity fund opportunities. Prior to that, she was a senior research associate in the Private Real Assets group at Cambridge Associates. Danielle received a BA (cum laude) in International Affairs and Economics from Northeastern University in 2011 and an MBA from the University of Michigan in 2019.

Julie Donegan

Director – Real Estate

CalSTRS

Julie Donegan became the Director of Real Estate in August 2023, and is responsible for directing an investment staff of over 25 people and overseeing a real estate portfolio totaling approximately $50 billion as of July 31, 2023. Ms. Donegan joined CalSTRS in December 2019 as a Portfolio Manager focused on residential assets which includes development, acquisitions, and Real Estate operating company ownership. Ms. Donegan’s work experience includes nearly ten years at Franklin Real Asset Advisors where she served as Senior Vice President and was a voting member of the Global Real Estate Investment Committee. She also served as a Senior Vice President with Eastdil Secured where she primarily focused on manager due diligence, private fund structuring, joint ventures, and structured finance transactions. Ms. Donegan began her career at CalPERS where she was an investment officer responsible for the $2 billion non-core real estate program. She holds a B.S. in Business Management. Ms. Donegan is a member of PREA (Pension Real Estate Association), Urban Land Institute (ULI), and Commercial Real Estate Women (CREW) where she served on the National Board of Directors and has been a member of the Sacramento chapter for more than 20 years.

Tahira Dosani

Managing Partner

ResilienceVC

Tahira Dosani is a founder and managing partner of ResilienceVC, an early stage embedded fintech fund investing in scalable startups that drive returns and resilience. She focuses on investing in and supporting fintech and non-financial services businesses that embed fintech to build financial resilience for American consumers and small businesses. Previously she served as the Managing Director of Accion Venture Lab, a seed-stage venture capital impact investing fund focused on inclusive fintech. Prior to that, Tahira was at LeapFrog Investments, an emerging market private equity impact fund focused on financial services, and worked as Director of Strategy at the Aga Khan Fund for Economic Development where she drove strategic initiatives for portfolio companies and led new investments in telecoms, technology and infrastructure in Asia. She also worked at Roshan, Afghanistan’s leading telecommunications operator, where she was Head of Corporate Strategy and helped launch the country’s first mobile money platform. Tahira began her career as a management consultant with Bain & Company in Boston. Tahira holds an MBA from INSEAD and BAs in International Relations, Computer Science, and Education from Brown University and is a professor teaching courses on Venture Capital and Impact Investing at Georgetown University and Johns Hopkins University.

Raudline Etienne

Founder and CEO

Daraja Capital

Raudline Etienne is the Founder and CEO of Daraja Capital, an investment and advisory firm providing seed capital to new, diversely owned, private fund managers and independent sponsors. Ms. Etienne has over 25 years of experience in institutional investing and consulting. She previously served as CIO for the New York State Common Retirement Fund, the third largest public fund in the U.S., where she managed a global multi-asset portfolio supporting the fund’s pension beneficiaries. During her tenure, she established multiple thematic investment strategies focused on climate, emerging managers, and innovation. Prior to her role as CIO, Ms. Etienne spent more than a decade advising institutional investors at RogersCasey where she developed wide expertise in multiple asset classes, investment strategies, as well as institutional investment managers. In addition to these roles, Ms. Etienne also served as a Senior Advisor/ Senior Director at global strategy firm Albright Stonebridge Group (ASG) where she focused on expanding opportunities in the investment sector both for ASG and its clients. Currently, Ms. Etienne is a trustee of the Janus Henderson Funds Board and a member of the Board of Advisors of Brightwood Capital, a capital provider to U.S.-based middle market enterprises. She serves on the Investment Committee of The Cooper Union for the Advancement of Science and Art’s Endowment. Past board roles include Van Alen Institute, Connecticut Hedge Fund Association, and the Toigo Foundation. Ms. Etienne earned a Bachelor of Science degree from the Massachusetts Institute of Technology and an MBA in finance from the University of California at Berkeley where she was awarded the Toigo Foundation Fellowship.

Sarah Favaro

Director of Investments

Sawdust Investment Management Corp.

Sarah Favaro is a Director of Investments at Sawdust Investment Management Corp, a private investment company that manages the investment portfolios of the Circle of Service Foundation and a single family office created by the founder of CDW. Sarah is a generalist on the team overseeing investments across all asset classes & helps set the strategic direction of the portfolios. Sarah has a BSBA in Finance & Entrepreneurship from the University of Arizona and is a CFA charterholder.

Tilly Franklin

CEO and Chief Investment Officer

University of Cambridge Investment Management Limited

Tilly Franklin is CEO and Chief Investment Officer at University of Cambridge Investment Management Limited, the fund manager of the Cambridge University Endowment Fund. She joined the University in January 2020 from her previous role as Director of Investments and Head of Private Equity at Alta Advisers, one of Europe’s leading single family investment offices. An alumna of Jesus College, Cambridge, Tilly was also a Principal at private equity firm Apax Partners Ltd, where she led a number of successful leveraged buyout transactions during her eight-year tenure. Earlier in her career, she also held positions at BBC Worldwide Ltd, Virgin Management Ltd and McKinsey & Company. Tilly is a Founder of GAIN (Girls Are Investors), a charity which aims to inform and inspire the next generation of female investment managers in the UK. She is also a Finance Trustee of the Kennedy Memorial Trust. Tilly is a Fellow of the 2017 class of the Finance Leaders Fellowship at the Aspen Institute, and a member of the Aspen Global Leadership Network. She holds a first class degree from Cambridge University in English Literature and an MBA from London Business School, and was a Kennedy Scholar at Harvard’s Graduate School of Arts and Sciences.

Susanne Gealy

Senior Director

CommonSpirit Health

Susanne Gealy, CAIA, is a Senior Director of the investments team at CommonSpirit Health, which she joined in 2018. Across the $25 billion endowment-style Treasury investment program, Susanne leads public equity and equity long/short hedge fund investments and is engaged in real assets investments. Additionally, Susanne is a member of CommonSpirit Health’s Defined Contribution Committee, which oversees $16 billion in participant investments.

At the Teacher Retirement System of Texas, Susanne led the $28 billion global external equity program and worked with emerging managers. Previously, she worked in New York at a family office, asset management and investment banking. Susanne holds an M.B.A. from the University of Chicago’s Booth School of Business and earned a B.S. and MS. in engineering degrees from the University of Texas at Austin.

CommonSpirit Health and its investment program are aligned with the social determinants of health and diversity, equity, inclusion and belonging. Susanne is a member of the Steering Committee of IADEI, an allocator-driven DEI expansion community. CommonSpirit is a signatory of the ILPA Diversity in Action initiative. Susanne is based in San Francisco.

Heather Gelchion

Managing Director

Rockefeller Capital Management

Heather Gelchion is a Managing Director and Senior Investment Advisor in the Global Family Office. She works with high-net-worth individuals and families, as well as non-profit organizations. Heather serves on the investment advisory board of the Greer Anderson funds.

Prior to joining Rockefeller in 2019, Heather was at Cambridge Associates for 14 years, serving as a Managing Director managing investment portfolios for multi-generational families, endowments and foundations. Heather’s clients were located both in the U.S. and Europe, ranging in asset size from $50 million to over $3 billion. While at Cambridge, Heather co-founded Prevail, a women’s network that brought together investors, asset managers, entrepreneurs, and philanthropists. Prior to joining Cambridge Associates in 2005, Heather worked at Standard and Poor’s as an Associate Ratings Analyst in the Structured Finance Group. In this position, she primarily rated asset-backed securities, including mortgage-backed and auto loan transactions.

Heather received an M.B.A. from the Johnson School of Management of Cornell University and a B.A. in Economics and European History from Brown University. Heather currently serves on the Advisory Board of Glasswing Ventures, the Investment Committee of the Rockefeller Family Fund and on the board of Friends of Dana-Farber.

Jennifer Friel Goldstein

Head of Business Development and Strategic Initiatives

Silicon Valley Bank

Jennifer Friel Goldstein is the Head of Business Development and Strategic Initiatives for Life Science and Healthcare (LSHC) banking at Silicon Valley Bank, a division of First Citizen Bank. In this role, Ms. Goldstein leverages her 20+ year experience financing life sciences innovation to identify market opportunities to connect VC and industry stakeholders to SVB’s clients and prospects. Since joining SVB in 2012, Ms. Goldstein has held a variety of leadership positions across the bank, where she played key roles in developing SVB’s biotech practice, supporting the expansion into investment banking, and revitalizing the approach to coordinated business development. Most recently, she was a Managing Partner with venture investing firm SVB Capital, where she launched and led its first dedicated Life Sciences investment team. Prior to joining SVB, Ms. Goldstein served as a Director on Pfizer’s venture capital team where she helped lead or co-lead investments into life sciences companies, served as a management consultant at Bain & Co. focused on private equity projects across Europe, and held operational and research roles at Chiron, Genelabs, and Genencor. Ms. Goldstein graduated magna cum laude with a bachelor’s degree in bioengineering and a master’s degree in biotechnology from the University of Pennsylvania. She also holds an MBA from the Wharton School, where she was named a Joseph Wharton Fellow. Her additional director roles include Venture Forward, Springboard Enterprises, the Women’s Health Innovation Coalition, and the Leukemia & Lymphoma Society in Northern California. Jennifer lives in the Bay Area with her husband and their twin children.

Caroline Gillespie Greer

Managing Director

Commonfund

Caroline Greer is a member of the Commonfund OCIO Investment team and is primarily responsible for hedge fund manager due diligence and for diverse manager investments across asset classes. Caroline currently serves as a member of the Commonfund Diversity, Equity and Inclusion Office and Commonfund OCIO’s Investment Committee. Prior to joining Commonfund, she served as a Partner and Principal for Contego Capital Management, LLC, specializing in customized funds of hedge funds. She was responsible for sourcing, evaluating and monitoring hedge fund managers across a full range of strategies. Prior to joining Contego, Caroline was a Senior Vice President for Oppenheimer and Co. where she co-managed their funds of hedge funds program and monitored Oppenheimer’s private equity fund. Caroline began her career at Montrose Advisors, a boutique financial advisor specializing in managing customized funds of hedge funds and private equity and venture capital portfolios. In 2015, Caroline was named one of the 50 Leading Women in Hedge Funds globally by The Hedge Fund Journal. Caroline received a B.A. in Political Science from the University of Toronto, and an M.A. and M.Phil. from Columbia University of New York.

Rashmi Gopinath

General Partner

B Capital

Rashmi Gopinath is a General Partner at B Capital Group where she leads the fund’s enterprise software practice in cloud infrastructure, cybersecurity, devops, AI/ML, and application software sectors. She brings over two decades of experience investing and operating in cutting-edge enterprise technologies. She led B Capital’s investments in over 24 companies such as DataRobot, FalconX, Clari, Phenom People, Synack, Innovaccer, Labelbox, Fabric, 6Sense, Highspot, Pendo, Starburst, OwnBackup, Figment, Perimeter81 (acq. by CHKP), Zesty, among others. Rashmi was previously a Managing Director at M12, Microsoft’s venture fund, where she led investments globally in enterprise software and sat on several boards including Synack, Innovaccer, Contrast Security, Frame (acq. by NTNX), UnravelData, Incorta, among others. Prior to M12, Rashmi was an Investment Director with Intel Capital where she was involved in the firm’s investments in startups including MongoDB (Nasdaq: MDB), ForeScout (Nasdaq: FSCT), Maginatics (acq. by EMC), BlueData (acq. by HPE), among others. Rashmi held operating roles at high-growth startups such as BlueData (acq. by HPE) and Couchbase (Nasdaq: BASE) where she led global business development, product and marketing roles. She began her career in engineering and product roles at Oracle and GE Healthcare. She earned an M.B.A. from Northwestern University, and a B.S. in Electrical Engineering from University of Mumbai in India.

Linda Greub

Co-Founder/Managing Partner

Avestria Ventures

Over 30+ years, Linda has invested in public and private life science companies as an institutional investor, a corporate M&A executive, a hedge fund analyst, and a private venture investor. She’s held roles at companies such as Essex Investment Management, Banc of America Securities, Novartis Diagnostics, Applied Biosystems (sold to Life Technologies Corp.) as well as at venture-backed life science companies such as VitaPath Genetics, Singulex, Raindance Technologies (sold to Bio-Rad), and Linkage Biosciences (sold to Thermo Fisher). Her areas of expertise not only include finance, operations, and mergers and acquisitions but also the life sciences, specifically, diagnostics, genomics, healthcare services, and life science tools. In 2019, she co-founded Avestria Ventures, which invests in early-stage women’s health and female-led life science ventures.

Stephanie Hackett

Partner

Evercore Wealth Management

Stephanie Hackett | Partner, Portfolio Manager Stephanie is a Partner and Portfolio Manager at Evercore Wealth Management. She is a member of the firm’s External Manager Selection Committee, which is responsible for the selection, due diligence and ongoing monitoring of all third-party investment managers. She is primarily responsible for research and due diligence on illiquid investments, encompassing private equity, real estate and credit. Stephanie joined Evercore in 2014 from Brandywine Group Advisors, a multifamily office, where she worked for eight years as an investment director, responsible for all aspects of the investment process. She previously worked at J.P. Morgan for seven years, focused on alternative asset management and private banking. She has significant experience in managing portfolios for high net worth individuals and families that invest in both alternative and traditional asset classes, including public equity, fixed income, hedge funds and private equity strategies. She received her B.A. from the University of Colorado and her M.B.A. from Rice University’s Jones Graduate School of Business. Stephanie holds the Chartered Financial Analyst designation.

Ananya Handa

Senior Investment Associate

The Harry and Jeanette Weinberg Foundation

Ananya serves as a generalist on the internal investment team at the Harry and Jeanette Weinberg Foundation. The Foundation is dedicated to meeting the basic needs of people experiencing poverty. Grants focus on supporting organizations that serve older adults, women and children at risk, people with disabilities, veterans, and the Jewish community in the areas of Housing, Health, Jobs, Education, and Community Services. Prior to joining the Foundation’s investment team, Ananya worked with higher education and healthcare clients at FEG Investment Advisors, assisting institutions with aspects of portfolio management spanning asset allocation, manager due diligence, and risk management. Ananya earned a BBA in Finance and MS in Finance from the University of Cincinnati. She is a Chartered Financial Analyst and holds the Chartered Alternative Investment Analyst (CAIA) designation.

Jeremy J. Heer, CFA, CAIA

Managing Director

University of Illinois Foundation

Jeremy Heer is a Managing Director at the University of Illinois Foundation. In his role he advances learning, research, and engagement activities within the Investment Office, leading and supporting the Foundation’s thesis-driven and outbound sourcing efforts. Jeremy has previously held investment management roles at the University of Chicago, Singer Partners, UBS, and Morgan Stanley, as well as other financial industry roles at Morgan Stanley and Cargill. Jeremy earned an MBA from New York University and a BS from the University of Illinois at Urbana-Champaign. He is a CFA and CAIA charterholder and an active volunteer for both of these communities.

Spring Hollis

CEO

Star Strong Capital

Spring Hollis is the CEO and founder of Star Strong Capital, an asset manager focusing on direct lending transactions. Prior to founding Star Strong Capital, Ms. Hollis served as a portfolio manager at Park Cities Asset Management, a Dallas, Texas based fund focused on specialty finance sector. Prior to that, Ms. Hollis was a managing director at Deutsche Bank in the global principal finance group, managing a proprietary trading strategy focused on esoteric assets on the bank’s balance sheet. Spring went to the University of Wisconsin and New York University School of Law and now lives in Connecticut.

Jessica Hornung

Director, Business Leader

Artisan Partners – China Post-Venture

Jessica L. Hornung is a director of Artisan Partners. She is responsible for overseeing the marketing and investor relations effort for the Artisan China Post-Venture Strategy. Prior to joining Artisan Partners in January 2022, she was a director of investor relations for Mingshi Investment Management, a Shanghai-based quantitative equity firm dedicated to investing in China A-Shares. Before that, Ms. Hornung served as an institutional sales associate for Corbin Capital Partners, a New York-based multi-strategy, multi-manager firm. Ms. Hornung holds a bachelor’s degree in political science with a minor in Eastern Asian languages and civilizations from the University of Pennsylvania. She received her Chartered Alternative Investment Analyst (CAIA) designation in 2020.

Denise Hu

CIO

Rockhampton Management Limited – Archer Asia

Founding Partner, Chief Investment Officer Denise Hu founded multi-family office Archer Asia in 2009 and has over 20 years of Asian hedge fund industry and market experience. She runs the firm’s investment functions and oversees a team which advises a number of esteemed families and institutions on Asian alternative investment funds. Denise and her team’s mission is to be the partner of choice for global allocators seeking a trusted channel to access the Asian investment opportunity. Denise began her career as an equity derivatives strategist at Merrill Lynch (Hong Kong). In 2003, she joined SAIL Advisors, the family office of Robert W. Miller and became a Portfolio Manager and led the firm’s Asian hedge fund research and investment portfolios. Denise is the Chair of Education Committee of 100 Women in Finance – Hong Kong Chapter and she is a Director of the Rockhampton Management Philanthropic Fund which supports the educational needs for the underprivileged in Hong Kong and Japan. She graduated from the Tepper School of Business at Carnegie Mellon University, United States.

Taylor Jackson

Investment Director

Verger Capital

Taylor’s primary responsibilities at Verger include sourcing, due diligence, and on-going monitoring of current and prospective investment managers; active participation in all investment decisions, including asset allocation and portfolio construction; and the development and oversight of performance reporting, analytics, and market commentary. Prior to joining Verger, Taylor worked as an Investment Analyst on the private equity team for the North Carolina Department of State Treasurer. Taylor earned his bachelor’s degree in business administration, with a concentration in finance, from North Carolina State University, and is a CFA® charterholder. Additionally, Taylor serves on the Finance and Investment Subcommittee for the Winston-Salem Foundation, a community foundation supporting charitable programs in Forsyth County. Outside of the office, Taylor enjoys playing and watching sports, caddying for his son’s in golf tournaments and spending time with his wife and kids.

Kirsty Jenkinson

Investment Director

CalSTRS

Kirsty Jenkinson is the Investment Director for the Sustainable Investment and Stewardship Strategies (SISS) team at CalSTRS, the largest educator-only public pension fund in the world with an investment portfolio valued at over $310 billion. Kirsty sits on the Investment branch Senior Management Team and is responsible for managing over $6 billion in sustainability-focused investment strategies across public and private assets as well as overseeing CalSTRS’ stewardship activities, including corporate engagement and proxy voting, and outreach with the fund’s stakeholders. Prior to joining CalSTRS, Kirsty was a managing director at Wespath Benefits and Investments in Chicago and was the director of the Markets and Enterprise Program at the World Resources Institute (WRI), a Washington, D.C.-based global research organization focused on the environment and economic development. Before moving to the United States, Kirsty was director of governance and sustainable investment at F&C Asset Management (now Columbia Threadneedle Investments) and an executive director in the Fixed Income division of Goldman Sachs in London. Kirsty is on the boards of Ceres and the Business and Human Rights Resource Centre, is a member of the International Sustainability Standards Board (ISSB) Investor Advisory Group and a member of the Advisory Council of the Investment Integration Project (TIIP). Kirsty holds an M.A. degree in international history from the University of Edinburgh, Scotland.

Allyson Johnson

VP of Investor Relations

Eclipse

Allyson has worked in IR and fundraising across geographies and asset classes since 2015. She started her career in banking, living and working in New York, Dubai and Singapore.

Allyson graduated from Duke University with a BA in Mathematics. She is a CAIA charterholder and has passed Level II of the CFA exam. She has been an active volunteer for 100 Women in Finance since 2014 and sits on the board of Summer Search Bay Area.

In her spare time, Allyson enjoys travel, hiking, yoga, skiing, cooking, and exploring the Bay Area’s restaurants and wineries.

Lacey Johnson

Managing Director

Grinnell College

Lacey is a Managing Director on the investment team at Grinnell College, where she focuses on private assets. She was previously a Managing Partner at Alumni Ventures, a $1 billion network-powered venture capital firm, where she was responsible for sourcing and investment due diligence. Prior to that, Lacey was an investment associate at CareGroup Investment Office, an associate at J.P. Morgan, and an analyst in the Securities Division of Goldman Sachs. She earned a bachelor’s in history from Middlebury College and an MBA from The Tuck School of Business at Dartmouth.

Ryan Karaian

Portfolio Director

Advocate Health

Ryan Karaian has built and managed private portfolios on behalf of hospital systems, pension funds, sovereign wealth funds, family office/fund-of-funds and financial institutions. Ryan is a Portfolio Director at Advocate Health where he covers all private asset classes with a focus on buyout, growth, and venture strategies. In addition to constructing fund portfolios, Ryan has designed and managed co-investment programs, has significant experience in secondary transactions and has led high-performing teams. Prior to joining Advocate, Ryan was at Children’s Healthcare of Atlanta and spent time as a globetrotter working at some of the largest investment programs on the planet including PSP Investments in Montreal and ADIA in Abu Dhabi. Ryan began his career at Bank of America. Ryan earned his MBA from UNC Chapel Hill and his bachelor’s degree in finance and accounting from Washington University in St. Louis. Ryan is a CFA charterholder.

Jessica Kennedy

Associate Professor of Management

Vanderbilt University

Jessica Kennedy is an expert in negotiation and conflict resolution. She leads original research on these topics as an Associate Professor of Management at Vanderbilt University. She started her career in investment banking at Goldman Sachs and Lazard. Kennedy earned her BS from The Wharton School at the University of Pennsylvania and a PhD from Haas at UC Berkeley.

Rebecca Kerner Reiss

Head of Business Development and Investor Relations

Patient Capital Management

Rebecca Kerner Reiss serves as the Head of Business Development and Investor Relations for Patient Capital Management, a woman owned and operated $1.6bln investment manager. Before joining the Firm in July 2021, Rebecca worked for Levin Easterly Partners (previously Levin Capital Strategies) for six years as the Director of Business Development. From 2012-2014, she was a Client Relationship Manager with Atlantic Investment Management. Prior to joining Atlantic Investment Management, Rebecca spent 5 years at Vision Capital Advisors in Marketing and Investor Relations. She graduated from University of Wisconsin – Madison with a BS in Sociology and Communication. Rebecca served on the Allocator Committee of 100WF Women’s Week, the steering committee of NASP’s Women’s Forum as well as serving as a mentor for 100WF LaunchME Program and Rock the Street, Wall Street career development program. She has been a panelist and moderator for various organizations including Live Girl, Viable Edu, 100WF and NASP.

June Kim

Director, Global Equity

CalSTRS

As Director of Global Equity for the California State Teachers’ Retirement System, June Kim is responsible for the pension fund’s $120 billion public equity portfolio. June is a member of the fund’s Risk Allocation Committee, which makes tactical asset allocation decisions for the total fund, and she chairs CalSTRS Investment’s Diversity Steering Committee. Prior to joining CalSTRS, June was head of public equity for the Los Angeles County Employees Retirement Association. Her earlier experience includes index and quantitative portfolio management at Barclays Global Investors, Northern Trust, and Wilshire Asset Management, and institutional foreign exchange sales at Citibank. She is currently on the advisory board for Girls Who Invest, a non-profit dedicated to increasing the number of women in the asset management industry. June received her B.A. in Business Economics from the University of California at Los Angeles and is a 2019 Finance Leaders Fellow of the Aspen Institute and a member of the Aspen Global Leadership Network.

Anastassia Kobeleva

Managing Director

CPP Investments

Anastassia Kobeleva is a Managing Director, External Portfolio Management, at CPP Investments, maintaining a portfolio of externally managed funds and separately managed accounts across public market strategies. She has over 15 years of investment experience spanning investment banking and allocation roles in the hedge fund space. She invests in established and emerging managers globally. Anastassia joined CPP Investments in January 2012 from Loewen & Partners, a private equity investment banking firm, where she held the role of Senior Associate. She serves on the Leadership Development Advisory Council for Capitalize for Kids and previously served as an executive committee member for 100 Women in Finance in Toronto.

Daniella Kranjac

Founding GP

Avant Bio

Daniella is Founding GP at Avant Bio, where her interests lie in advancing early stage and growth investments in life science industrials. Daniella previously led investments in FloDesign Sonics (acquired by MilliporeSigma), Envisagenics, RoosterBio, CellFE Biotech, Virica Biotech, and Vernal Biosciences among others. Previously, Daniella spent seven years at GE Healthcare (now Danaher, Cytiva), where she supported the acquisition and led the integration of several companies creating a several hundred million dollar division. She was also co-founder of Wave Biotech LLC and Wave Europe Pvt. Ltd for which she led strategy, global sales, product management and marketing, building the company and successful exit to GE Healthcare.

Alena Kuprevich

Founding Partner, Managing Director

Disciplina

Alena Kuprevich is a founding partner of Disciplina. Alena is responsible for sourcing, due diligence, portfolio construction and monitoring of all of the illiquid alternatives. Alena is also on the Investment Committee for Disciplina. In addition, Alena is a lead contact for several of the firm’s endowment and pension clients. Previously, she held the position of Managing Director of Private Investments at Vanderbilt University’s Office of Investments (2008 – 2013), which accounted for approximately 40% of the $4 billion endowment portfolio. Prior to working at Vanderbilt, Alena worked with the FINRA (2007-2008) and Emory University (2001-2006) endowments. During her tenure at these organizations, Alena was responsible for multi-manager portfolios across several asset classes including Private Equity, Venture Capital, Energy, Real Estate, Hedge Funds and International Equities. Over her career, she has committed over $1 billion of capital globally to private investment firms. Alena holds a Bachelor of Business degree and a M.B.A. from Emory University (2000 and 2005). Alena is invited as a frequent speaker at various industry conferences and has held numerous Investor Advisory seats for investment managers.

Yan Kvitko

Managing Director

CPP Investments

Yan Kvitko is a Managing Director with CPP Investments’ External Portfolio Management (EPM) team. Yan is responsible for the Emerging Manager program globally which pursues investments in early stage hedge fund managers. Prior to joining CPP in 2019, he worked at New Holland Capital where he was a Senior Portfolio Manager responsible for investment research and portfolio management with a focus on quantitative strategies. Yan began his career at Ziff Brothers Investments. Yan holds a BS in Computer Science from Stanford University and an MA in piano performance from the Conservatorium van Amsterdam. He is a CFA Charterholder.

Tetiana Kyslytsyna

Hedge Fund & Sustainable Investment Officer

UBS Hedge Fund Solutions

Tetiana Kyslytsyna, CAIA, is a Hedge Fund and Sustainable Investment Officer for UBS Hedge Fund Solutions (HFS). Tetiana is responsible for investment due diligence of Fundamental Relative Value, Event Driven, and Multi-Strategy hedge funds. Tetiana is also responsible for the shaping and evolution of HFS’ ESG investment assessment framework across hedge fund strategies, as well as working on dedicated hedge fund portfolios that incorporate sustainable investment considerations, and providing thought leadership on ESG related matters to internal and external audiences. Previously, she was a Hedge Fund Advisory Specialist (2016-2019) within UBS Wealth Management Investment Platforms and Solutions in Switzerland, advising on customized hedge fund portfolios of UHNW and HNW clients. Tetiana has 10 years of investment industry experience, holds an MSc in Finance from the UCD Michael Smurfit Graduate Business School in Dublin, Ireland, and is a CAIA charterholder.

Justina Lai

Chief Impact Officer and Shareholder

Wetherby Asset Management / Laird Norton Wealth Management

Justina is the Chief Impact Officer at Laird Norton Wealth Management and Wetherby Asset Management, registered investment advisory firms with over $13 billion in combined assets under management, including $2+ billion invested in impact strategies. Justina is a recognized leader and frequent speaker on impact investing with over 20 years of experience in a variety of investment, strategic, partnership management and field building roles in the impact and broader investment industry. Justina has a multi-faceted role, leading the firm’s impact investing strategy as well as the integration of impact across its stakeholder groups and investment management, client service, and operational functions. Justina is responsible for overseeing the firm’s holistic implementation of impact including corporate social responsibility; diversity, equity and inclusion; and environmental stewardship initiatives. Prior to joining Wetherby in 2015, she led the development and implementation of global impact investment strategies across the private markets at Sonen Capital and the Rockefeller Foundation where she also helped shape the foundation’s grantmaking strategy to build the impact investing field. Justina has also held positions with Legacy Venture, a venture capital fund of funds, and Rwanda Ventures, a business incubator launching and operating sustainable agricultural companies Rwanda. Prior to her career in impact investing, she worked across the US and Europe in investment banking with Citigroup and private equity with Vestar Capital Partners. Justina received an MBA with certificates in Public and Global Management from Stanford University’s Graduate School of Business and a B.S. in Finance and International Business, summa cum laude, from New York University. Beyond her work, Justina is committed to engaging fully in her local and global communities. She serves on the Board of Trustees and the Investment Committee and chairs the PRI Committee for the San Francisco Foundation, one of the nation’s largest community foundations. She is also a Board Member and Investment Committee Chair of ICA, a Community Development Financial Institution (CDFI) investing in high potential businesses to close the racial and gender wealth gaps. Justina is Professional Faculty at the University of California, Berkeley’s Haas School of Business and is a Fellow of the RSA.

La Keisha Landrum Pierre

Managing Director and Co-founder

Emmeline Ventures

La Keisha Landrum Pierre is the Co-Founder and Managing Director at Emmeline Ventures, an early-stage VC fund, where she invests in healthcare, fintech, and sustainability solutions built by female founders. She invests in the most promising female founders across these sectors and has spent the last 13+ years building world-class operational teams, infusing strategic excellence and scalability into impact-focused companies. Prior to Emmeline Ventures, La Keisha was the Managing Director of NLA Ventures, an early-stage fund where she also invested in healthcare, sustainability, and cybersecurity. Prior to NLA Ventures, La Keisha built a career working at the intersection of tech, impact, and digital media. As the CEO of one of Nigeria’s largest digital media start-ups, Sahara Reporters Media Group, La Keisha built and scaled the first civic media platform of its kind. With venture backing for an African company when Africa was an overlooked market, she grew the company from 2MM to 50MM monthly users, positioning it for investment by impact funds, and raising millions in funding. She partnered with the Omidyar Network, MacArthur, Google, and Bloomberg Philanthropies to found the first-of-its-kind Civic Media Lab, Lagos with support from the MIT Center for Civic Media. There, she was the Executive Director and today sits on the board of the Civic Media Lab, Nigeria. She is also now the Chairwoman of Sahara Reporters. La Keisha is a 2x founder of Harvard Innovation Lab incubated start-ups and was a deep-tech researcher at the Youth and Media Group at Harvard Law School’s Berkman Klein Center where she studied the intersection of digital and media literacies for youth. La Keisha brings domain expertise in building and scaling impact-driven companies, taking complex business challenges, and designing solutions that create lasting financial and social change in the world.

Allie Levine

Senior Investment Associate

University of Michigan

Allie Levine is a Senior Investment Associate at the University of Michigan Investment Office where she covers private equity and venture capital strategies. Previously, she worked across the endowment’s public equity and absolute return strategies and completed a legal operations rotation as well. Allie serves on the CFA Society of Detroit Women’s Advisory Council. She holds a Bachelor of Business Administration from the University of Michigan and is a CFA charterholder.

Irina Ludkovski

Partner, ODD

Albourne

Irina Ludkovski, Partner, Operational Due Diligence, Albourne America LLC. Irina has over 15 years of alternative assets experience and is a senior member of the global ODD Group, leading and contributing to internal strategic initiatives. Irina holds a Bachelor of Commerce degree from the University of Toronto and is a CFA charterholder.

Linda Luu

Principal

The Blackstone Group

Karen A. Mair

Managing Director & Head of Fixed Income

Attucks Asset Management

Karen A. Mair is a Managing Director and Head of Fixed Income at Attucks Asset Management, a manager of emerging managers in public securities markets that manages $3.9 billion for institutional clients. She oversees $1.7 billion in fixed income assets under management and is responsible for constructing and managing client investment programs. Karen also leads Emerging Manager research and due diligence across global fixed income sectors. She has 25 years of experience in the financial services industry, including prior roles at Merrill Lynch and the Federal Reserve Bank of NY. She earned a B.A. from Trinity College (Phi Beta Kappa) and an Master’s in Public Policy in Finance & Economics from Harvard University.

Eric Mason

Managing Director

The Church Pension Fund

Eric Rogan Mason Managing Director, Head of Global Private Equity Eric Mason is the Managing Director and global head of Private Equity for The Church Pension Fund (CPF). Based in New York, he is responsible for leading the global private equity portfolio including venture, growth, and buyout strategies. He also oversees the Fund’s investments in Asia, having opened the Hong Kong office when he joined CPF in 2009. Eric was based in Asia for over 27 years before relocating to the New York office in 2022. Prior to CPF, Eric served as the founding partner for the Carlyle Group’s Asia Leveraged Finance Fund. Before that he was Regional Head of Leveraged Finance for J.P. Morgan in Asia, where he worked for more than 12 years. At JPMorgan, Eric led the underwriting of many of the landmark private equity LBOs in Asia. In the early 1990s Eric taught at the Foreign Affairs College in Beijing, China with Princeton in Asia (PIA) and before that worked on Capitol Hill in Washington DC for a US Senator. Eric earned a Master of International Affairs (MIA) at Columbia University from the School of International and Public Affairs (SIPA), where he earned a Dean’s List scholarship. He received a BA in economics from the University of Delaware. Eric speaks Mandarin Chinese.

Julia Mattox

Client Solutions

Capricorn Investment Group

Julia Mattox is a Manager on the Client Solutions Team. She joined Capricorn in 2020. Prior to Capricorn, Julia worked in portfolio management and client solutions for PAAMCO Prisma, an alternative investment management firm, where she worked on custom hedge fund portfolios for institutional clients. Julia received her B.A. in Economics from the University of Virginia and holds the Chartered Alternative Investment Analyst (CAIA) designation.

Alexandra McGuigan

Global Director of Strategic Initiatives

100 Women in Finance

Alexandra McGuigan is the Global Director of Strategic Initiatives for 100 Women in Finance and the Founder & CEO of Inclusive AM, a Singapore firm focused on changing the face of asset management by increasing the flow of institutional capital to female fund managers. Alexandra has helped global fund managers develop a presence in the APAC region, raising over $2.5 billion AUM. She was Head of Investor Relations at Tribeca IP and has worked with GAM, Adveq, Och Ziff and Qblue Balanced. Alexandra completed the Wharton Certificate in Asset Allocation and Portfolio Construction; is a CAIA Charterholder and Singapore Chapter Executive; holds an MBA from UTS, and a BA from Sydney University.

Cynthia Muller

Director of Mission Investment

W.K. Kellogg Foundation

Cynthia Muller is the director of Mission Investment for the W.K. Kellogg Foundation based out of Battle Creek, Michigan. In this role, she supports foundation efforts to promote thriving children, working families and equitable communities.

Muller is responsible for driving the strategy and performance of the foundation’s $100 million mission driven investments portfolio. She also oversees the foundation’s $30 million program – related investment portfolio and managing strategic impact investment activities that address systemic barriers that create vulnerable conditions for historically marginalized communities and children. Cynthia came to the foundation in September 2016 as the program and portfolio officer where she was responsible for developing and managing strategic market rate impact investment activities; sourcing and deploying market rate investments to increase social change impact; analyzing solutions and trends; and developing relationships in the field.

Prior to joining the foundation, Muller developed and managed Arabella Advisors impact investing practice where she helped foundations and individuals understand the field of impact investing; develop strategies and structure investments to accomplish their social and environmental goals. During her tenure she oversaw deal sourcing and structuring of investments in health, education, microfinance, housing, and green technology—both domestically and internationally. Muller also led several evaluations of impact investment portfolios, and she regularly presented and blogged about trends and practices within the field.

Muller previously worked in community development finance as well as community-based health care in Indigenous communities. She serves on boards of Next Chapter, Enterprise Loan Fund and Mission Investors Exchange.

Muller holds a Master of Business Administration from the Foster School of Business at the University of Washington and a bachelor’s degree in psychology from Stanford University.

Diana Murakhovskaya

General Partner & Co-Founder

The Artemis Fund

A decade in tech investment banking M&A and institutional commodities sales company led to a desire to improve the lives of women. After building and launching the first women-only iPhone app for new friends and networking, I became compelled to solve the difficulties women founders faced rather than build only one company and solve only one type of problem. Through the Monarq Incubator we powered exceptinal women-led companies providing them with all the resources, mentorship and introductions they need to raise their next round. We sold to a great partner and my funding journey continued with The Artemis Fund. Now as Co-Founder and GP at The Artemis Fund we are a VC fund that leads seed rounds of female tech innovators modernizing wealth through fintech, e-commerce infrastructure, and care-tech.

Darren Myers

Director of Research

Agility OCIO

Darren Myers is a Partner at Agility and Director of Research for the firm. He also leads Agility’s Absolute Return investment program. Prior to joining Agility, he served as a Senior Research Analyst at Tejas Securities Group, Inc., where he provided investment recommendations on special situation and distressed debt opportunities. Darren was previously a Senior Analyst at UTIMCO focusing on hedge fund investments for the $3 billion Marketable Alternative Investments portfolio. He also worked at Perry Capital, LLC, a multi-billion dollar private investment management firm. Darren holds a BA degree in the Plan II Honors Program and an MBA, both from the University of Texas at Austin. He also serves on the MBA Advisory Board at the University of Texas at Austin. Darren is a CFA charterholder. He is an active endurance athlete, having completed the Atacama Crossing in Chile, the RacingthePlanet Ultramarathon in Georgia, and IRONMAN North Carolina.

Theresa Nardone

Investment Analyst

RockCreek

Theresa Nardone is a Senior Analyst at RockCreek, part of the public equities team, with a focus on global long only strategies. She began at RockCreek through the summer analyst program, interpreting risk data and visualizing impact metrics. Prior to joining RockCreek, Theresa spent her summers doing policy research and data analytics in the public sector, and environmental research in Cusco, Peru. She received her B.A. in Public Policy with minors in Psychology and Spanish from the Sanford School of Public Policy at Duke University. In her free time, Theresa enjoys backpacking and rooting for the Blue Devils.

Lisa Ann Needle, CFA

Partner, Senior Analyst HF IDD

Albourne

Lisa joined Albourne in 2011 after having been a client for four years. At Albourne, she is a Senior Analyst on the HF IDD team covering equity long/short. Before 2018, she was a Senior Analyst in the Portfolio Group. Prior to joining Albourne, Lisa was at pension fund SDCERA, where she spent eleven years. She was Asst CIO from 2004 to 2009 and then CIO until 2011. Lisa has an MBA for SDSU and a BS from UC Davis. She is a CFA Charterholder.

Marcia Nelson

Managing Director

Freedom Capital Markets

Marcia is a Managing Director at Freedom Capital Markets (FCM) and oversees the family office division. The majority of her career has been working in and for family offices and private dealmakers. Prior to FCM, Marcia was a Managing Director and head of business development for ShareNett, a members-only global network of professional investors, and she worked previously at Alberleen Family Office Solutions, an independent investment advisory firm backed by family offices. She formerly worked for an ultra-high-net-worth philanthropic family as well as a sports and entertainment family. Over the last 20 years, she has developed a strong network of private families, institutional investors, and advisers who are increasingly seeking access to quality direct deal flow from trusted, experienced partners.

Triple C Advisory is a business life cycle consulting firm that works with early stage companies as an advisor and board member to prepare them to receive institutional-grade investments.

Marcia is a Founding Council Member of the Family Office Association (FOA), a Global Impact Peer Community. She serves as Chairman of the Board of Kinect Capital, a Utah-based non-profit early-stage accelerator; on the Board of University Impact, a donor-advised fund focused on impact investing; and on the Advisory Board of Angel Accelerator Fund, a VC fund investing in media. She is a past president of ACG-NY, an association for middle market dealmaking professionals, and is a member of The DealmakeHers, an exclusive network of leading female dealmakers in the retail and consumer marketplace.

Marcia speaks regularly on topics relating to Family Offices, Venture Investing, Entrepreneurship, and Diversity, Equity & Inclusion. She received an honorary mention as one of the 2021 Most Influential Women in Mid-Market M&A by Mergers & Acquisitions magazine and was named one of the 2020 Most Influential Women and she was one of the 2018 Who’s Who In Impact Investing by the Denver Business Journal. She was honored with the 2017 ACG-NY Women of Leadership Award.

Ms. Nelson received her BA from Southern Utah State College and her MBA from the Gabelli School at Fordham University. Marcia holds Series 7 and 63 licenses.

Kate Nevin

President + Portfolio Manager

TSWII Capital Advisors

Kate is President of TSWII Capital Advisors and Portfolio Manager for both TSWII and TSWS focused on investments in hedge funds, venture capital and other alternative strategies. Her career has spanned more than two decades, beginning as an analyst in New York City in the early 2000’s with Lehman Brothers. She is a member of 100 Women in Finance, PEWIN, and the Nexus Impact Society. Kate currently serves on the LP Advisory Committee for Hannah Grey Ventures and Rethink Food. She is a founding member of Asteri Collective, and is currently serving on the Editorial Committee of the Academy of Institutional Investors. She is Founder + Board Chair Emeritus of Enough Pie, a non-profit in Charleston, SC. Kate is an Anchor Partner in the Diverse Investing Collective. Kate has received the CAIA (Chartered Alternative Investment Analyst) designation, the alternative investment industry’s first and only specialized educational standard. She received a Bachelor of Arts degree from the University of North Carolina at Chapel Hill in 1999 and completed The Executive Program of the University of Virginia’s Darden School of Business in June 2004. Kate was a 2014 Diversity Leadership Fellow at the Riley Institute of Furman University. Kate often speaks and moderates at conferences and participates on committees advocating gender equality and conservation. Kate lives on a sea island outside of Charleston, SC with her husband and 3 children.

Marianne O

Co-Founder, Partner, and Portfolio Manager

Lumen Global Investments

Marianne is a Co-Founder, Partner, and Portfolio Manager at Lumen Global Investments (LGI) in San Francisco, an investment organization that leverages data and technology for detailed global asset allocation, portfolio construction, and risk management. Before LGI, Marianne co-founded Lumen Advisors, LLC, a top-down, value-focused hedge fund across multiple asset classes. In 2005, Lumen’s global value hedge fund, led by Dr. Simon Nocera, won the best Relative Value Strategy from Global Fund Analysis. Earlier, she worked in G.T. Global (LGT), Dresdner RCM Global Investors, Tradewinds Financial, and Citicorp International Limited. Marianne has been researching and investing in global developed and emerging markets across equities, bonds, currencies, and commodities for over 25 years in the U.S. and spent 5 years in Hong Kong in Loan Syndication working with Asian borrowers. She is a Chartered Financial Analyst (CFA) and received her MBA in Finance from UC Berkeley Haas School of Business and her M.A. and B.A. (HONS) in Economics from the University of Cambridge, U.K. She co-chairs 100 Women in Finance (100WF) in Northern California and is a member of the 100 Women in FinTech global committee. She currently sits on the investment committee of Asian Health Services (non-profit) in Oakland, California.

Shannon O’Leary

Chief Investment Officer

Saint Paul & Minnesota Foundation

As Chief Investment Officer, Shannon O’Leary oversees the Foundation’s Investments team as well as all aspects of the Foundation’s $1.7 billion investment portfolios for individual donors, nonprofit endowment holders as well as two partner foundations, F. R. Bigelow Foundation and Mardag Foundation. In her role, Shannon works closely with the investment committees, Foundation staff and others on portfolio decision-making to maintain and grow assets that sustain the Foundations’ grantmaking, ensuring secure annual income and offering other investment funding, education and capacity-building resources for the 200+ nonprofits it serves. Since joining the Foundation in 2019, Shannon has implemented an approach that both quantifies and preferences Diversity, Equity, and Inclusion as well as ESG investing strategies that align with the Foundation’s work to inspire generosity, advocate for equity, and invest in community-led solutions.

Aubrie Pagano

General Partner

Alpaca VC

Aubrie brings experience from both sides of the New York City startup ecosystem as both an operator and investor. Most recently, she built and sold her cult-favorite apparel and gifting brand, Bow & Drape. Aubrie drove the omni-channel brand to profitability by retailing online DTC and in over 350 Nordstrom, Bloomingdale’s, Macy’s and Hudson’s Bay stores. At Alpaca VC, she focuses on leading early stage investments in all things commerce.

Amy Poster

Managing Principal

Alpha Pacific Strategies LLC

Ms. Poster is a risk, regulatory, and governmental affairs consultant. Her consulting experience in financial services, focuses on accounting, financial, regulatory and compliance reporting, internal audit, controls, and implementation of risk technology solutions for banks, broker/dealers and hedge funds. Ms. Poster’s consulting clientele range in size from Citigroup, UBS to small Fintech startups. Amy completed a term assignment as a Senior Policy Advisor at the US Department of Treasury, Office of the Special Inspector General- TARP (SIGTARP), overseeing financial markets and domestic policy. She led critical audits on TARP recipients and Federal inter-agency investigations. Prior to her role at SIGTARP, Amy was Director in Product Control at Credit Suisse, focusing on risk and valuation for global credit products within the Fixed Income Division. In addition, Amy led the set up and post-launch risk management of several credit and distressed funds within Credit Suisse’ Alternative Capital Division. Earlier in her career, she designed and implemented risk and valuation programs at Donaldson, Lufkin, and Jenrette and Bear Stearns. She started as a business analyst at Lehman Brothers. Amy is currently a contributing writer for Forbes.com and has been published in Pensions and Investment magazine, Institutional Investor, Alpha, Money Management Intelligence, and the Global Association of Risk Professionals (GARP) Risk News magazines. She holds an MBA in Financial Management with Distinction from Pace University. Ms. Poster is a Board Director for New York City based Solar 1, a 501 (c)(3) green energy education center. She is also on the Advisory Council of 100 Women in Finance and a senior advisor at private equity fund, Turning Rock Partners.

Lilian L Quah

Quantamental Equity Investor

Most recently, Lilian was a portfolio manager for the Emerging Markets Equity Strategy, the Head of Quantitative Research, and a member of the Quantitative Research and Risk Management team at TD Epoch. Prior to joining TD Epoch in 2013, she spent five years at AllianceBernstein, where she was a senior quantitative analyst in the Value Equities Group. Before Bernstein, Lilian was a senior consultant in the finance practice at the ERS Group, an economics consulting firm. Lilian has a BA in Economics from Wellesley College and a Masters in Economics from Stanford University. She is a Past President and current board member of the Society of Quantitative Analysts (SQA).

Christine Ritchie, CFA

Managing Director, Investment Risk and Operations

Hackensack Meridian Health, Inc.

Christine is the Managing Director of Investment Risk and Operations at Hackensack Meridian Health where she manages all back-office functions and the Operational Due Diligence program. The Hackensack Investment Office manages $7 billion in Balance Sheet and Pension assets. Prior to joining Hackensack, she had a similar role at the Carlton College endowment. Before moving to the endowments & foundations world, she was the Head of Global Operations at a $15 billion multi-strat hedge fund, a Risk Manager at Goldman Sachs (NY and HK), held multiple roles at Merrill Lynch, and started her career as an accountant and for two global accounting firms. Christine earned her Master’s and Bachelor’s in Accounting from The University of Texas at Austin and is a CPA and a CFA Charterholder.

Ulrika Robertsson

Co-Founder

Impactus Partners

Ulrika Robertsson is an Impact Investment entrepreneur with 20+ years of international Capital Markets, Quantitative Trading and Alternative Investments experience. Ms. Robertsson is a founding partner of Impactus Partners, a Private Investment office and Placement Agency for Alternative Investments. Impactus aims to generate positive environmental and social impact through capital allocation, and serves a curated network of fund managers seeking to raise capital from institutional asset owners. Ms. Robertsson’s primary professional interests sit in climate solutions and energy transition. Additionally, she is an outcomes-oriented leader in the movement toward gender equality in the financial services industry, prioritising systems change to drive capital allocation to female fund managers. Ms. Robertsson was appointed to the Board of Directors of 100 Women in Finance in 2022. Prior to her appointment to the Board, she chaired the organisation’s Global FundWomen Week conference. Foundational years of her career were spent at Goldman Sachs and UBS.

Paula Robinson

Director, Equity Manager Research

WTW