Speakers In-Person 2023

Details to follow shortly for 2024

Leena Bhutta

Chief Investment Officer

Doris Duke Foundation

Leena serves as the CIO of Doris Duke Foundation, an organization working on building a world that is more creative, equitable and sustainable. Leena joined the foundation in 2019. She started her career in technology investment banking at Goldman Sachs. Subsequently she spent many years investing in global public markets at a Tiger-cub hedge fund, Joho Capital. In 2011, she switched from her direct investing role to help the founders of Joho set up an investment program for their private foundation (Hollyhock Foundation) and family capital. Leena earned her BA from Wellesley College and her MBA from the Stanford Graduate School of Business.

Quincy Brown

SVP Institutional Services

FEG Investment Advisors

Quincy Brown is the Senior Vice President of Institutional Services and Advisor at FEG. He joined FEG in 1996. Within FEG, Quincy leads or serves on various committees, including Diversity Equity and Inclusion, Diverse Manager, Responsive Investment, Culture, Business Continuity, Technology Steering and Recruitment Sub-Committee. Previously, Quincy served as FEG’s Director of Client Service. Quincy is currently a member of the University of Dayton Flyer Investment Fund Advisory Board, the YWCA of Greater Cincinnati Finance Committee, and formerly a board and advisory council member of The Know Theatre of Cincinnati. Quincy graduated from The Ohio State University with a Bachelor of Science in Accounting and Finance.

Sherrese Clarke Soares

Founder & CEO

,HarbourView Equity Partners

Sherrese Clarke Soares is a visionary 2-time Founder & CEO having spent over 20 years in corporate finance, capital markets, investment banking, and private equity. Prior to starting HarbourView, Sherrese Clarke Soares founded Tempo Music where she served as CEO and Board Director. At Tempo, Sherrese formed a strategic partnership with Warner Music Group, brought on Providence Equity Partners to back the venture, and delivered an above average IRR for the investment class. Previously, Sherrese was a Managing Director at Morgan Stanley, having spent close to 15 years in several roles at the firm and most recently leading the Entertainment, Media, & Sports Structured Solutions Platform, devising a cross asset strategy focused on capital solutions for intellectual property. During her 10-year tenure, she managed the origination and execution of $85B+ in loan commitments for the firm and served as Deputy Chair of the Capital Commitment Committee. Prior to Morgan Stanley, Sherrese was one of the three founding senior leaders to develop the Entertainment Practice at CIT Group, overseeing a $1B portfolio across entertainment companies. Sherrese received a B.S. in Finance from Georgetown University and an M.B.A. from Harvard Business School. She is a former board member of Evoqua Holdings (NYSE: AQUA) and Planned Parenthood Federation of America where she serves as Treasurer and Chair of the Finance Committee. She is also a board trustee at Carnegie Hall. She is a recipient of the Billboard 2021 Change Agent, Class of 2020 – 2022 Women in Music awards, 2022 Power list and the Buyouts Class of 2022 Women in PE. She was also included in the Variety Women’s Impact Report 2022 and Inc. Magazine’s 2023 Female Founders Most Dynamic Women Entrepreneurs List.

Lionel Erdely

Co-CEO and CIO

Investcorp-Tages

Lionel Erdely is Co-CEO and CIO of Investcorp-Tages. He joined Investcorp as Head and CIO of the Absolute Return Investments division in 2013. Prior to this, Lionel worked for 11 years at Lyxor Asset Management, where he held the dual position of Chief Investment Officer (2004 – 2013) and Chief Executive Officer of Lyxor Inc. (2009 – 2013). Previously, he was Vice President in the Equity Corporate Finance department at Société Générale. Lionel has an MBA Degree in Finance from the École Supérieure des Sciences Économiques et Commerciales (ESSEC) in Paris.

Ivelina Green

CIO

Pearlstone Alternative

Ivelina Green is the Founder and CIO of Pearlstone Alternative, a London-based credit asset manager focused on special situations and distressed investing. Pearlstone seeks idiosyncratic opportunities with high execution complexity in companies which come under cyclical and structural pressure.

Prior to launching Pearlstone, Ivelina was a Partner at CQS, where she headed the Global Special Situations Group. In this capacity, Ivelina was a senior portfolio manager and built a global team of dedicated special situations analysts based in London, New York and Hong Kong.

Prior to CQS, Ivelina was a Head of European Distressed Trading and Investing at Goldman Sachs in London. She started her career at Goldman Sachs in 2004 in New York.

Ivelina has been actively involved in various female leadership and mentoring initiatives seeking to promote women in finance throughout her career at Goldman Sachs and later at CQS and Pearlstone. She was named to the Hedge Fund Journal’s Leading Women in Hedge Funds in 2018. Ivelina was also named to the HFJ’s Global Report of Leading Portfolio Managers for 2021. She was recently recognized in the 2023 iConnections Women at the Forefront of Alternative Investments Report.

Maria Jelescu Dreyfus

CIO

Ardinall Investment Management

Maria is the Founder and CIO of Ardinall Investment Management, an investment firm focused on sustainable investing and resilient infrastructure that she started in 2017. Prior to Ardinall Investment Management, Ms. Dreyfus spent 15 years at Goldman Sachs, where she most recently served as a Portfolio Manager and Managing Director in the Goldman Sachs Investment Partners (GSIP) Group. She currently serves as a director on the boards of Pioneer Natural Resources (NYSE: PXD), Nabors Energy Transition Corp (NYSE: NETC), Cadiz Inc (NADSAQ: CDZI), CDPQ (Canadian pension plan), and on the board of Eni’s corporate venture arm. Additionally, she is the Vice Chair of the advisory board of the Center on Global Energy Policy at Columbia University and Co-chair of its Women in Energy program. Ms. Dreyfus is also a member of the MIT Corporation’s Development Committee and sits on the MIT Economics Department’s Visiting Committee. Other non-profit board memberships include the Global CCS Foundation, New America Alliance, and Girls Inc. of NYC. Ms. Dreyfus has held her CFA since 2004, and holds a dual degree in economics and management science from the Massachusetts Institute of Technology.

Meredith Jenkins

Chief Investment Officer

Trinity Church Wall Street

Julie Donegan became the Director of Real Estate in August 2023, and is responsible for directing an investment staff of over 25 people and overseeing a real estate portfolio totaling approximately $50 billion as of July 31, 2023. Ms. Donegan joined CalSTRS in December 2019 as a Portfolio Manager focused on residential assets which includes development, acquisitions, and Real Estate operating company ownership. Ms. Donegan’s work experience includes nearly ten years at Franklin Real Asset Advisors where she served as Senior Vice President and was a voting member of the Global Real Estate Investment Committee. She also served as a Senior Vice President with Eastdil Secured where she primarily focused on manager due diligence, private fund structuring, joint ventures, and structured finance transactions. Ms. Donegan began her career at CalPERS where she was an investment officer responsible for the $2 billion non-core real estate program. She holds a B.S. in Business Management. Ms. Donegan is a member of PREA (Pension Real Estate Association), Urban Land Institute (ULI), and Commercial Real Estate Women (CREW) where she served on the National Board of Directors and has been a member of the Sacramento chapter for more than 20 years.Meredith B. Jenkins is chief investment officer for Trinity Wall Street, where she is responsible for the investment management and oversight of the church’s endowment and real estate holdings. Prior to joining Trinity, Ms. Jenkins was the co-chief investment officer of Carnegie Corporation of New York, Andrew Carnegie’s foundation, from 2011 to 2016. She joined in 1999 as its first investment associate and was an integral part of the build-out of the corporation’s investment capability under its first chief investment officer. After moving to Hong Kong in 2007 for family reasons, she served as the corporation’s special representative to Hong Kong, focusing on investment opportunities in Asia, including China, Japan, India, Southeast Asia and Australia. During this time, she continued as an active member of the investment leadership team. Before joining Carnegie Corporation, she was a buy-side equity research associate for Sanford C. Bernstein & Co. and an investment banking analyst at Goldman Sachs. Ms. Jenkins received a B.A. in English language and literature, with distinction, from the University of Virginia, where she was elected to Phi Beta Kappa, and an M.B.A. degree from Harvard Business School. She serves on the board of trustees of the University of Virginia Investment Management Company and on the investment committees and boards of trustees of The Wenner-Gren Foundation, The Josiah Macy Jr. Foundation, and The Windward School.

Dana Johns

Head of Private Equity

New Jersey Division of Investment

Dana S. Johns Ms. Johns joined the New Jersey Department of the Treasury, Division of Investment in 2023 as the Head of Private Equity. Prior to New Jersey she was a member of the Private Equity team at the Maryland State Retirement and Pension System and is an experienced private markets investor and leader in the U.S. public pension and broader institutional investor community. Ms. Johns has over 20 years of experience investing and managing multi-billion dollar global portfolios of institutional alternative investment assets. She has deep expertise in private equity and a highly developed personal network with established top performing private equity fund managers and next generation managers. Ms. Johns has a demonstrated long-term track record for selecting and managing strong performing private equity fund portfolios. She is committed to supporting discourse and initiatives focused on the thoughtful advancement of private markets investing and creating pathways to inclusion for underrepresented talent in private equity. Industry recognition includes the Wall Street Journal Pro Private Equity 2023 Women to Watch, Institutional Investor’s Global List of Top 50 Women in Investment Management, Trusted Insight’s list of Top Public Pension Investors Directors, and PEWIN’s Member of the Year highlighting Ms. Johns’ work in transforming the private equity industry with a focus on diversity, equity and inclusion. Ms. Johns is Board Chair of the Private Equity Women Investor Network (PEWIN), and a member of the Institutional Limited Partners Association (ILPA) Diversity & Inclusion Advisory Council, Academy for Institutional Investors Editorial Committee, AIF Women’s Leadership Steering Committee and the SEO Alternative Investments Limited Partner Advisory Council. Ms. Johns has both a B.A. in Comparative Literature from Indiana University Bloomington and a B.S. in Computer Info Systems from Stevenson University. She graduated from Loyola University Maryland with a Master’s in Finance while working full time as an Associate at Camden Private Capital, a private equity fund of funds.

Christine Kelleher

Chief of Investments

National Gallery of Art

Christine Zapotoczky Kelleher is chief of investments at the National Gallery of Art, responsible for managing the Gallery’s $1+ billion endowment. Previously, Christine served as senior investment officer for Georgetown University. She co-founded Georgetown’s Investment Office in 2004 and served as acting chief investment officer in 2011. After Georgetown, Christine led investment strategy, sourcing, and evaluation for Avec Capital, a boutique investment advisory and placement firm. Earlier in her career, she served on the executive team of the Central European University, founded by George Soros, in Budapest, Hungary. Christine is a member of the board of trustees for the Montgomery County Employee Retirement Plans and Consolidated Retiree Health Benefits Trust, investment committee of the American Chemical Society, Milken Institute’s Global Markets Advisory Council, and The Academy for Institutional Investors’ editorial board. She serves as a mentor for Accel CIO, accelerating tomorrow’s Black & Latino chief investment officers, and she previously served as an advisor to the Kayo Conference Series supporting women investors, as a member of the YWCA National Capital Area’s finance committee, as a board member for the NHS Scholarship Fund, and as president of the board of directors of the Bucknell University Alumni Association. She received a BA in Russian and international relations from Bucknell University and holds MAs in Russian and East European studies and in Central European history from Georgetown University. She lives in Washington, DC with her husband and son.

Michelle Knudsen

Senior Portfolio Manager

The Andrew W Mellon Foundation

Michelle Knudsen is a senior portfolio manager at the Andrew W Mellon Foundation. She works with the chief investment officer to manage Mellon’s endowment across asset classes with a focus on diversifying strategies. Prior to joining Mellon, Michelle was the head of absolute return and credit strategies at Partners Capital, an outsourced investment office. There, she was a member of the investment committee with responsibility for investments across hedge fund and liquid credit strategies. She also led the firm’s global efforts to source new investments and managed the New York office. Michelle previously worked at Goldman Sachs & Co. as an investment analyst in the San Francisco office. She holds a BA in political science from Stanford University.

Melody Koh

Partner

NextView Ventures

Melody is a Partner at NextView Ventures based in its New York office. She has spent her entire career working with technology and Internet startups as an entrepreneur, operator, and investor. Prior to joining NextView, Melody was Head of Product at Blue Apron (NYSE: APRN). Melody joined Blue Apron as the first product hire when the company was 18 months old with 20 HQ employees. She helped scale the business through hyper-growth (25x in 3.5 years) and to its IPO, building and leading a 35-person team across Product Management, Product Design, and Analytics/Data Science. Previously, Melody was a Product Manager at Fab.com leading marketing & analytics products and the founder/CEO of a seed-funded wine subscription e-commerce service. Melody was also a venture investor at Time Warner’s strategic VC group and was a one of six inaugural members of First Round Capital’s Product Co-op initiative. Melody began her career as a tech/media M&A investment banking analyst at Evercore Partners. Melody holds an MBA with Distinction from the Harvard Business School and a BS in Commerce with Distinction from the McIntire School of Commerce at the University of Virginia.

Emily Mendell

Executive Director

PEWIN

Ms. Mendell brings to PEWIN three decades of leadership within the venture capital and private equity ecosystems. Specifically, she possesses deep experience in advocating for general and limited partners on a global basis. She has previously served in leadership positions at two of the private equity and venture capital industries’ venerable trade associations: the National Venture Capital Association (NVCA) and the Institutional Limited Partners Association (ILPA). She also served as Head of Communications for Polaris Partners. Most recently, she was Director of Marketing and Communications at CenterSquare Investment Management, a global real estate investment firm. Ms. Mendell received her Bachelor of Science in Economics from The Wharton School of the University of Pennsylvania.

Eileen Overbaugh

Partner

Schulte Roth & Zabel LLP

Eileen Overbaugh focuses her practice on advising hedge funds, venture capital funds and other pooled investment vehicles on all matters related to private funds, including formation, structuring, investor negotiation and ongoing operations. She negotiates seed and strategic investments, funds-of-one, managed account arrangements and other alternative investment relationships, and also advises asset managers and institutional investors with respect to co-investments and single-asset funds. Eileen’s practice is focused particularly on the business arrangements between the principals of asset management firms, including governance of the investment manager and general partner entities. In addition, Eileen structures employee compensation and employee separation arrangements for both asset managers and their most senior employees and partners. Eileen is recognized as a leading investment funds lawyer for her work in the hedge funds space by Chambers USA, with clients stating that “she is highly strategic and can turn around issues quickly.”

Chrissie Pariso

Managing Director

MP

Chrissie co-leads MPowered Capital, bringing 20 years of investing experience to the role. As a former Senior Portfolio Manager of Private Equity at Exelon Corporation and Head of Exelon’s Women & Minority Manager Program, Chrissie brings a unique set of qualifications to MPowered. While at Exelon, Chrissie sourced, diligenced, and committed over $1.8 billion to 46 funds and 31 managers across venture capital, growth equity, buyout and distressed funds globally. Chrissie led Exelon’s Women and Minority-Owned Manager Program and developed and executed Exelon’s first Investment Office Diversity and Inclusion Survey across asset classes. Prior to Exelon, Chrissie was Vice President at middle-market buyout firm Sterling Partners. Chrissie received her B.A. from Georgetown University and her MBA from The University of Chicago – Booth School of Business. She is a board member and Midwest Steering Committee member for Women’s Association of Venture and Equity (WAVE). Additionally, Chrissie is a member of Private Equity Women’s Investor Network (PEWin).

MonaLisa Raass Como

Executive Director

IDiF, Inc.

MonaLisa Raass Como is a fintech executive with over two decades of financial services in scaling and transforming startups, large institutions, and emerging industries. She was previously the Chief Operating Officer of PayPal at Invest, President & COO at Capital One Investing, and E*TRADE as a startup to name a few. Ms. Como has deep philanthropic board experiences in advancing women-owned businesses and entrepreneurs, as well as destigmatizing mental health. MonaLisa, a mother of five and two dogs, resides in Washington DC with her husband Jay.

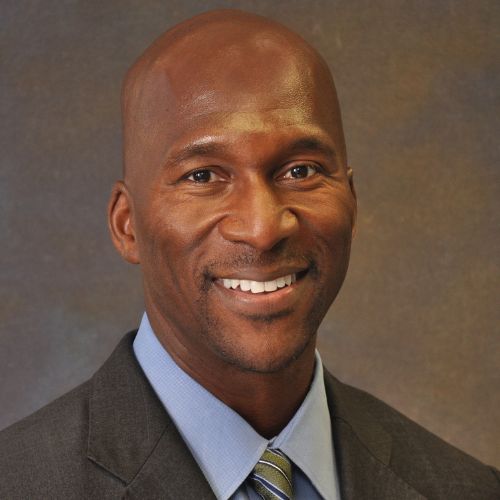

Reggie Sanders

Managing Director, Absolute Return and Fixed Income

W.K. Kellogg Foundation

Reginald G. Sanders, CFA, CAIA is Managing Director of Absolute Return & Fixed Income for the W.K. Kellogg Foundation, reporting to the Chief Investment Officer. Mr. Sanders also leads the W.K. Kellogg Foundation’s diverse manager strategy and also sits on the Foundation’s Impact Investment Committee.

Prior to the W.K. Kellogg Foundation, Mr. Sanders was Manager of Pension Investments for Eastman Kodak Company, where he was primarily responsible for managing the alternative asset classes, which included the hedge fund and illiquid investment programs, for the company’s U.S., U.K., and Canadian pension plans. Prior to Eastman Kodak, Mr. Sanders was an equity research analyst for AEW Capital Management. Mr. Sanders also has prior equity research analyst experience with both T. Rowe Price Associates, Inc. and GW&K Investment Management. Additionally, Mr. Sanders was a utilities industry analyst for A.G. Edwards & Sons, Inc.

Mr. Sanders holds a BS degree from Florida A&M University, where he was an SEO Career Program intern, and an MBA from Harvard Business School, where he was a Robert A. Toigo Fellow. Mr. Sanders currently sits on the State of Michigan Investment Board, on the Investment Advisory Committee of the Harry and Jeanette Weinberg Foundation, and on the Investment Committee for the endowment of the Cranbrook Schools. Mr. Sanders also sits on the board of Rock the Street, Wall Street, serves on the Limited Partner Advisory Council for SEO, is a founding steering committee member of IADEI (Institutional Allocators for Diversity, Equity and Inclusion), and serves on the CFA Institute’s D&I Steering Committee.

Deepika Sharma

Global Head of Manager Selection

BlackRock

Deepika (Dee) Sharma is the Global Head of Manager Selection for the Multi-Manager Platform at BlackRock. In this role, she is responsible for building multi-manager portfolios for the global Outsourced CIO (OCIO) business, across public and private market strategies as part of Multi-Asset Strategies & Solutions (MASS). The Multi-Asset Strategies & Solutions (MASS) team is the investment group at the heart of BlackRock’s portfolio construction, asset allocation, and active management ecosystem. MASS draws on the full toolkit of BlackRock’s investment capabilities to deliver precise investment outcomes and cutting-edge alpha insights. Deepika has spent over 15 years in portfolio management and multi-asset investing roles, with publications in the Journal of Investing, ACM AI in Finance and Beta Investment Strategies. Previously, Dee led product research and innovation focused on factors and fixed income and was responsible for proprietary systematic research to execute on client opportunities. Prior to joining BlackRock, she was a Portfolio Manager and Director of Investment Research at Astor Investment Management, a $2bn asset management firm, where she built a multi-alternative strategy awarded with Refinitiv Lipper awards for outstanding performance. She previously worked within the Fixed Income Proprietary Trading group at Nomura and began her career as an analyst on the structured credit desk at Lehman Brothers. Deepika most recently served as Chair of Board of Directors at CFA Society New York, the largest of the 142+ societies that comprise CFA Institute worldwide with over 10,000 members. She is also a member of the Milken Institute, Bretton Woods Committee and the Economic Club of New York. Deepika holds a Masters in International Finance at Columbia University.

Kirk Sims

Managing Director

TRS

Kirk Sims heads TRS’ Emerging Manager Program. Since being established in 2005, TRS has committed $5.9 billion to one of the largest programs of its kind. An additional $4.6 billion has been invested directly with EM Program graduates. Each graduate was selected as a result of consistent outperformance among a group of more than 218 EM managers. Sims joined the Teacher Retirement System of Texas on March 1, 2019. Before joining Texas Teachers, he was a Senior Investment Officer for the Teachers’ Retirement System of the State of Illinois. Sims had oversight and management responsibility of TRS’s Emerging Manager Program, a $750 million evergreen pool of capital designed to identify and invest in emerging investment managers across all asset classes. Prior, Sims worked at Prudential Retirement where he was responsible for a manager of manager’s retirement platform as well as an open architecture investment platform. He also has a background in asset management and has held various positions with both large and small asset managers. Sims is a CFA charter holder and holds a Masters in Business Administration from the Columbia University Graduate School of Business. He received a Bachelor of Business Administration from Howard University in Washington, DC.

Matthew Wright, CFA

President and Chief Investment Officer

Disciplina Group LLC

Matthew is the Founder, President and Chief Investment Officer of Disciplina Group LLC, an OCIO firm founded in 2013. He is former Vice Chancellor for Investments and Chief Investment Officer of Vanderbilt University. In his position, he built and led a twenty-person team responsible for investment oversight of the university’s $4.0 billion long-term investment portfolio, which included the university’s endowment. Specific duties entailed strategic and tactical asset allocation, investment manager selection, internal management, risk management, reporting and coordination with the university’s administration, alumni and the Board of Trust. Prior to joining Vanderbilt University, he was the Director of Investments at Emory University’s endowment, a portfolio manager with Bank of America Capital Management’s Quantitative Strategies Group and pension analyst Xerox Corporation’s Trust Investments department. He has a bachelor’s degree in Finance from Seton Hall University and holds an M.B.A. from the University of Rochester. He is also a member of the CFA Institute, Leadership Nashville Class of 2016, Investment Committee Member of Jack Kent Cooke Foundation, and Seton Hall University Board of Regents. He is also the Investment Committee Chair at Seton Hall University and member of the Executive Committee. Throughout his 30-year plus career, Matthew has been a featured speaker, moderator and panelist at industry conferences such as Institutional Investor, Thomson Reuters, NMS Management, and others. In addition, he has been featured in local and national publications regarding institutional investing and investment risk management. In 2017, he gave the commencement address for his alma mater at Seton Hall University’s 160th Commencement Ceremony. He has also lectured numerous times at Vanderbilt University’s Owen School of Business.

Joyce Zhang

Senior Investment Officer

The Wallace Foundation

Joyce Zhang joined the investment team at Wallace in 2016. She assists the chief investment officer in the management of the foundation’s investment portfolio. Her responsibilities include the monitoring of investment managers, and risk management and analytical support. Zhang worked as a senior fixed income trader at Ping An Asset Management, one of the largest insurance companies in China. There, she traded Chinese and Hong Kong stocks and international bonds for 200 portfolios with more than $100 billion in assets and was one of the firm’s top traders. Zhang received her M.B.A. from Yale University. She holds an M.S. in global business from Pepperdine University and a B.S. in electrical engineering from Sun Yat-sen University in Guangzhou, China. Zhang is both a chartered financial analyst (CFA) and chartered alternative investment analyst (CAIA).

Ashley Zohn

VP / Learning & Impact

Knight Foundation

Ashley Zohn joined Knight Foundation in January 2019 and was named vice president, Learning and Impact, in March 2021. Zohn, who has more than a decade of experience advancing data-driven decision-making in the nonprofit, public and private sectors, oversees Knight’s research and assessment portfolios. Knight commissions field-leading research on topics that affect communities, journalism and the arts, as well as surveys of public attitudes about the media, the First Amendment, and technology. Its assessment program increases the impact of grantmaking by evaluating Knight’s investments and sharing insights widely. Prior to Knight, Zohn oversaw the Continuous Improvement Program at the Federal Emergency Management Agency (FEMA). In this capacity, she was responsible for reviewing the agency’s responses following federally-declared disasters and building continuous improvement capacity at FEMA’s disaster operations. In other roles at FEMA, Zohn oversaw a research portfolio of internal research and analysis projects, including the FEMAStat program. Zohn also worked in community outreach at the American Red Cross. She began her career in marketing science. She holds a Bachelor of Arts in sociology from Princeton University, a Master of Business Administration from MIT Sloan School of Management and a Master of Public Administration from Harvard Kennedy School of Government. She is a native of Miami.